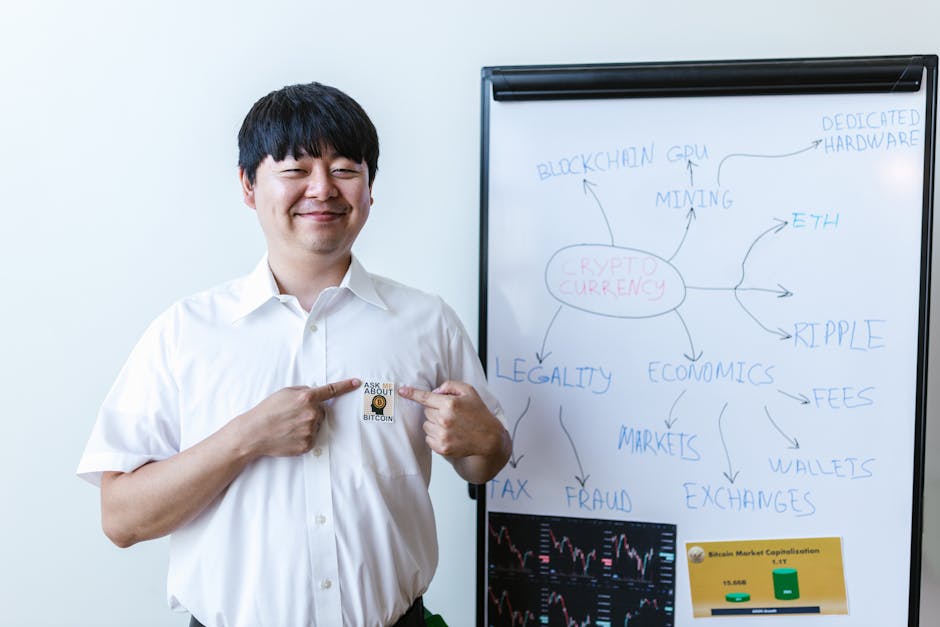

Are Profits From Crypto Currency Trading Taxable

As we have seen, investing in cryptocurrencies is popular these days. With their prices rising almost every day, people are engaging in crypto trading to make profits or save money by buying and selling cryptocurrency.

Some individuals begin investing heavily in cryptocurrencies as they see it as an opportunity to make big bucks. This got us thinking — if investing in cryptocurrencies is so lucrative, then why not do it for profit?

Many savvy investors recognize that you can easily invest in cryptocurrencies through various ways (exchanges, coin purchases, etc.). Therefore, there are many opportunities to earn income off of your investment without having to actually take possession of the coins.

The problem comes down to whether or not such earnings are taxable. If they are, then you must report them. Luckily, there are some easy ways to avoid this!

This article will go into more detail about what is and isn’t considered tax-free income, how to identify potential taxes with cryptocurrencies, and what steps you can take to ensure you don’t owe anything back.

Capital gains or losses

The other major type of income you can earn through crypto trading is called capital gains or loss. This occurs when you profit by selling an investment that is worth more than it was bought for. For example, if you spent $1,000 buying Bitcoin then sell it for $2,500, your gain would be $2,500 – $1,000 = $1,500.

If we did the same with Ethereum, your gain would be $3,000 – $1,200 = $2,000. We call this difference a capital gain or loss.

With tax season coming up where people will have to file their taxes, understanding how cryptocurrency trades affect taxation becomes even more important.

Trading cryptocurrencies like Bitcoin and Etherium are considered investments under the IRS guidelines. As such, any profits made from these currencies are taxable just like stocks or currency.

The tricky part comes in determining what kind of income they classify as “trade” related. They may consider anything you buy or sale within the blockchain (the underlying technology of most cryptocurrencies) to be trade-related. Therefore, all transactions done while holding must be reported!

This is why it is extremely important to keep accurate records of everything you purchase and sell so you do not forget about them.

Determining your capital gain or loss

The most important thing to know about investing is that you can make money (or lose money) very quickly! This is particularly true with cryptocurrencies as they have seen wild fluctuations in price over the past few years.

In fact, some experts say it’s more likely than not that we will see another bear market before the end of 2020. So, how do you prepare for this?

The first step is to determine if you recognize your cryptocurrency profits are taxable as income or assets. If so, then you must report them at least within the year!

Otherwise, any profit you made will be considered a capital gain which requires additional reporting requirements.

Determining your taxable income

A good way to determine if your crypto trading is tax exempt or not is to see whether or not you are required to report your gains in taxes. If you do have to file, then it has been determined that your trades are considered business transactions and are therefore taxed like any other investment.

If however, you don’t have to report your cryptocurrency sales, then they probably aren’t subject to taxation either. After all, why should you be obligated to declare an increase in wealth?

And while some people may feel guilty about avoiding taxation by hiding their profits, there is actually no obligation to disclose every bit of money you make. After all, what would people think when they find out how much you earn?

That being said, although most people never get audited, keeping track of your financials and having proof of your earnings can help ensure that you're okay with paying taxes later on.

So now let's talk about some ways to identify if your crypto trading is considered professional arm’s length activity or not.

You must report your crypto-related income

It is very important to understand that even if you are not actively trading, you may still need to declare your cryptocurrency earnings. This includes any kind of rewards you earned for holding or investing in cryptocurrencies, as well as dividends paid from token sales or ICOs.

Most major exchanges require their users to file tax forms called IRS Form 8949. On this form, you have to list all sources of revenue (paying with cryptocurrencies, owning cryptocurrencies, etc.), and determine whether it constitutes business income or personal income. Business income requires additional filing, depending on what category of business you run. Consider engaging a tax preparation service online to help answer detailed tax law questions.

Businesses can include anything from renting an apartment to running a cafe! For example, when Bitcoin was new, many people made a lot of money by buying them and reselling them at a profit. Because they were buying and selling them for profits, this was considered “business activity” under the law.

You must report your crypto-related expenses

Although investing in cryptocurrencies is not taxed as regular income, there are still costs associated with trading them that you should be aware of. Some of these include transaction fees for sending money to or from an exchange, market making software used to quickly buy or sell large quantities of cryptocurrency, and legal representation if something goes wrong.

In fact, according to a survey by Finder, almost half (46%) of all respondents said they incurred significant time investment into tax documents related to their crypto trades.

Calculate your profit or loss

The easiest way to determine if you owe money for crypto trading is by using an efficient, simple cost-benefit analysis. Simply put, you want to know two things: 1) Does this activity bring in enough income? And 2) What are the costs of doing this activity?

The cost of investing in cryptocurrencies can be expensive, which makes it hard to invest without taking debt. Many people begin investing when they cannot afford to lose their investment, making them spend more to stay invested. This cycle can sometimes lead to large debts and additional fees to finance that extra spending.

There are ways to remain within budget while still satisfying the first part of the cost-benefit analysis. By limiting how much you invest per week or per month, you will avoid excessive investments. Investing via bank accounts or credit cards can also reduce the risk of overspending.

Report your crypto-related income and expenses to the IRS

As mentioned before, keeping good records is important for tax time. This includes recording what you spend Your cryptocurrency on (for example, buying new laptops with Bitcoin or paying in Ethereum for a movie ticket), as well as documenting all of your trading activity, such as what exchanges you use and how much money you make during different trades.

Report your crypto-related income and expenses to the IRS

When reporting cryptocurrencies to the Internal Revenue Service, there are two main types of incomes that most people will recognize: gains and dividends. Both require some sort of documentation, so don’t forget to keep those recordings!

Gains occur when you sell off your cryptocurrency at a lower price than it was bought for. For instance, if you purchased $1,000 worth of Bitcoin one month ago and it now costs only $800 per coin, then you would likely report this loss as a gain and include it in your personal finances.

Likewise, if you received any type of dividend from your investment, tell your accountant about it! Most major stock market sites can provide you information on their site regarding whether or not these earnings are taxable.

The best way to avoid having to pay extra taxes is to be aware of what things should be reported and where.

Your crypto-related income and expenses could affect other areas of your financial life

As mentioned before, keeping up with cryptocurrency can be expensive!

If you are invested heavily in cryptocurrencies, then it is very important to understand how they relate to other parts of your finance career. These relationships vary depending on whether or not you are trading for profit.

When you are investing in cryptocurrencies for the first time, there’s usually an initial cost associated with buying some bitcoin or etherium. This cost typically includes fees to create a wallet, download software that exchanges give you, and purchase coins through their exchange platform.

Once you have paid this initial cost, you will need to find a way to store your coins. Some people choose to use web wallets like Coinbase where you upload your coins via a website, while others opt to use mobile apps such as MyEtherWallet (MEW) which are more versatile but less secure.

Leave Message